Crypto Staking: Under 5 Minutes [2022]

Crypto Staking is for the bold and savvy crypto souls. An easy process otherwise, however, can get a bit technical if you choose to DIY.

Simply put, you lock some amount, do computational work, and earn staking rewards.

But that won’t suffice. Will it?

So, fasten your seatbelts as we start this with the foremost…

What is Crypto Staking?

Crypto Staking is locking up staking-supported coins to a specific blockchain network to earn staking rewards. One can stake individually or with crypto exchanges/staking pools.

Let’s backtrack a little and first go through the consensus protocols.

There are many. But the top two are Proof-of-Work (PoW) which governs some notable blockchains like Bitcoin, and then there is Proof-of-Stake (PoS), to which Ethereum is planning to shift.

PoW is crypto mining. In short, it means all miners try to solve the crypto hash at once. And the first one to do it, arguably with the most computing power, wins the mining reward. The rest get nothing but an inflated electricity bill.

This centralized the mining power to the mega corporates with huge mining farms. In addition, the energy wastage was significant for the environmentalists to campaign against it.

Then came the savior, Proof-of-Stake. This consensus mechanism awards the transaction verification to the validators.

This way, a single validator is chosen according to various parameters like the staking amount, investment period, etc. Some networks also mix in a degree of randomness to decentralize the selection.

The validator invests with their computation to verify the transactions and get rewards. In addition, they get voting power in future network protocols.

Each network has specific minimum requirements for validators.

In addition to some system requirements, they may ask for a minimum stake in the native blockchain network. For instance, you need to have at least 32 ETH to run a full validator node on Ethereum. Or a 16 cores CPU with 256 GB ram for solo validating on the Solana network.

Conclusively, solo validating involves a higher degree of risk, investment, and in-depth technical knowledge that I believe is out of the scope of this article.

Read this interesting blog post on how a ConsenSys employee became a full validator on Ethereum 2.0.

Further sections primarily focus on a viable alternative: crypto staking in pools.

How does Crypto Staking Work (in Pools)?

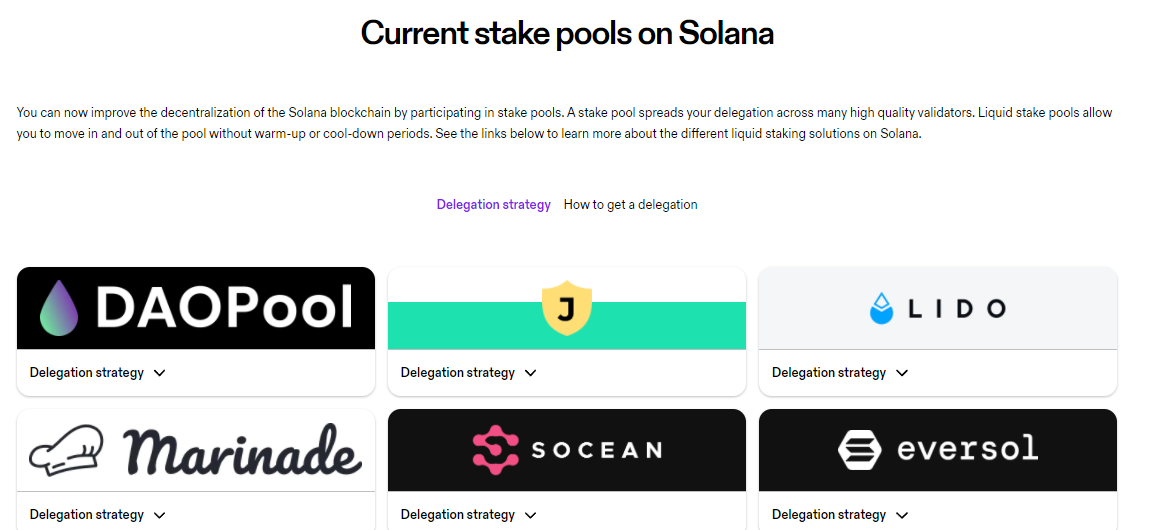

Crypto staking pools are supported by the crypto exchange platforms like Coinbase or Binance. There are, however, some 3rd-party staking pools, like it was with crypto mining platforms.

They handle the complicated software setup and hardware requirements.

For pool staking, you need to have sufficient cryptocurrency (specific to the pool) and the willingness to lock it up for the said period. This locking time again depends on the crypto network or the exchange.

It essentially means that the staked amount can’t be withdrawn before the contract expiry, no matter how lucrative the price jump you see on the markets.

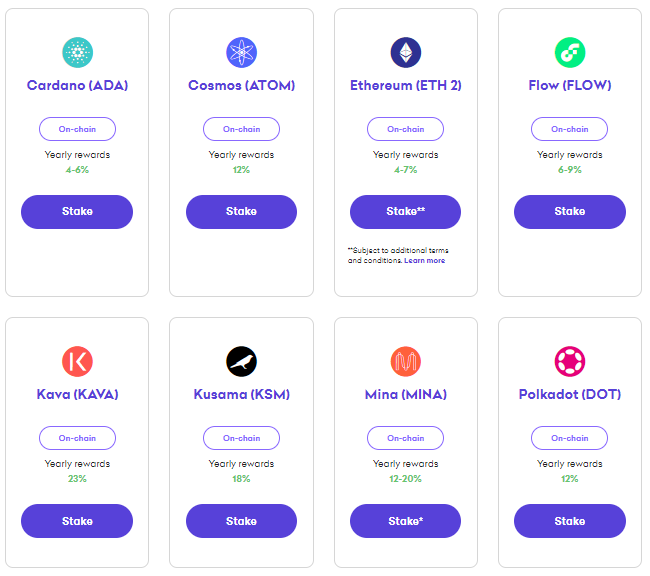

Staking awards are annualized returns you get, which are normally mentioned upfront. Some exchanges do pay more frequently, like Kraken, which pays twice a week.

After integrating a crypto wallet to the staking platform, one can stake coins with just a few clicks in staking pools. You get rewards after the lockup period, which are generally offered in the staked cryptocurrency.

In a nutshell, crypto staking is:

- Setting up a crypto wallet

- Purchasing (swapping for) staking coins

- Connecting Wallet with the staking exchange or pool

- Confirm staking

So now the million-dollar question:

Benefits and Risks of Crypto Staking

As crypto is yet to go mainstream as currencies, in essence, they are practically investing opportunities.

The prime advantage of staking is to earn on otherwise dust-collecting cryptocurrencies (excusing Metaverse Crypto Coins for now).

Conclusively, you get staking awards. These awards are generally in the form of staked cryptocurrency. Still, some platforms offer rewards in currencies other than the one you stake.

In addition to the supposed monetary benefits, you get the pride of supporting the project underneath. And as already mentioned, you’ll have a say in the network decisions based on your share.

Now hold tight for risks.

First, you can’t unstake and sell when you see the price touching the peaks. You’re locked up for the period, and the coin you staked in could fall flat during your contract period.

So, staking adds over the risks of already volatile crypto.

Besides, you rely on intermediaries by staking with exchanges/staking pools which undermines one of the core principles–zero trust–of blockchain technology.

Additionally, staking a coin with a smaller market cap can lead to a liquidity crisis while cashing out the rewards.

Finally, a hack on your staking pool or exchange can wipe out your investments with little hope of recovery whatsoever.

Conclusion

Crypto Staking is risky.

And it becomes almost stupid if you aren’t sure about the supporting crypto project.

Because many start every single day with flashing promises, yet 92% crash, with an average lifespan of just 1.22 years.

Still, a few succeed and gift their investors with unprecedented returns.

However, there is a much safer way if you’re interested in earning free crypto.

More great readings on Finance

-

7 Best Play to Earn Crypto Games To Check OutHitesh Sant on April 27, 2022

7 Best Play to Earn Crypto Games To Check OutHitesh Sant on April 27, 2022 -

8 Best Bitcoin/Crypto IRA Platforms in 2022Hitesh Sant on April 23, 2022

8 Best Bitcoin/Crypto IRA Platforms in 2022Hitesh Sant on April 23, 2022 -

How to Buy Land in The Metaverse [2022] + 7 Buying PlatformsHitesh Sant on April 18, 2022

How to Buy Land in The Metaverse [2022] + 7 Buying PlatformsHitesh Sant on April 18, 2022 -

A Guide to IoT in Banking and FintechDurga Prasad Acharya on April 6, 2022

A Guide to IoT in Banking and FintechDurga Prasad Acharya on April 6, 2022 -

Know These Lingo Before Doing Anything CryptoHitesh Sant on April 5, 2022

Know These Lingo Before Doing Anything CryptoHitesh Sant on April 5, 2022 -

11 Best PFP NFT Projects to Watch Out for in 2022Tamal Das on April 4, 2022

11 Best PFP NFT Projects to Watch Out for in 2022Tamal Das on April 4, 2022